China Insights Hub

Your go-to source for news and insights about China.

Cashback Loyalty Tiers: The Secret Recipe for Radically Rewarded Shopping

Unlock the secrets of cashback loyalty tiers and transform your shopping into a rewarding adventure. Discover how to maximize your rewards today!

Understanding Cashback Loyalty Tiers: How to Maximize Your Benefits

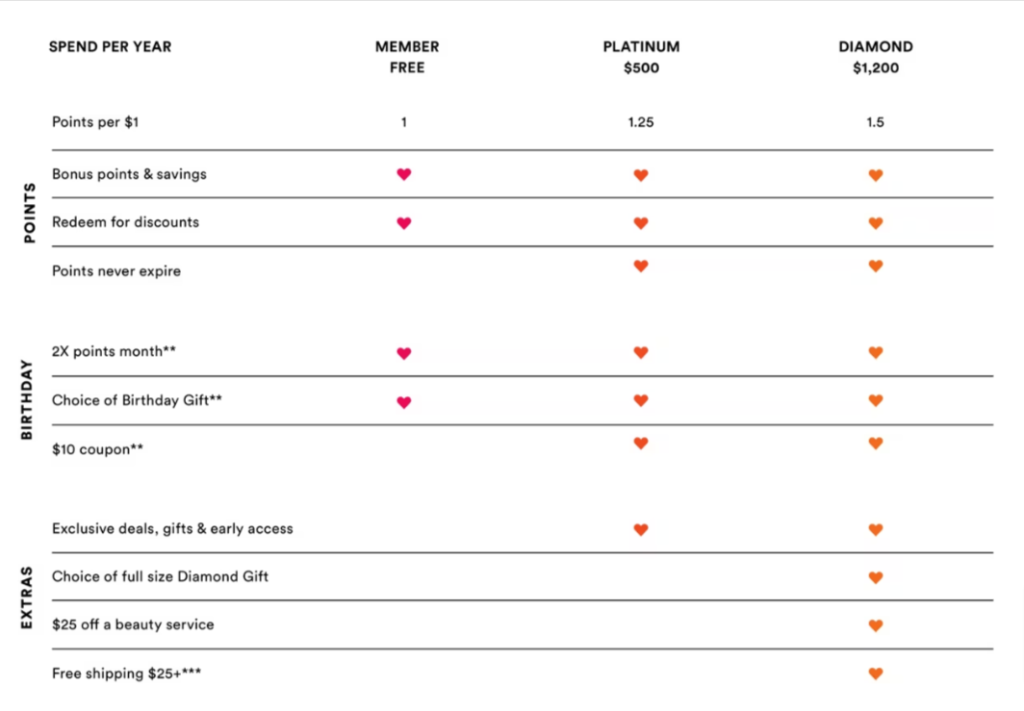

Understanding cashback loyalty tiers can significantly enhance your financial benefits when shopping. Many retailers and credit card companies offer tiered cashback programs where the percentage of cashback you earn increases based on your spending level or loyalty status. This means the more you spend, the better your rewards. For instance, a typical structure might look like this:

- 1% cashback on purchases up to $500

- 2% cashback on purchases between $500 and $1,500

- 3% cashback on all purchases over $1,500

By identifying the spending thresholds that unlock higher tiers, you can strategically plan your purchases to maximize your overall cashback.

To truly benefit from cashback loyalty tiers, consider tracking your spending habits and aligning them with the cashback program's requirements. One effective method is to create a monthly budget that allows you to reach the next tier without overspending. Additionally, utilizing cashback apps and programs for everyday purchases can help you accumulate points faster. Remember to regularly review the terms of your loyalty program, as benefits may change, and special promotions may arise that could temporarily enhance your earnings. By keeping informed, you can stay ahead and ensure you are reaping the maximum rewards the program has to offer.

Counter-Strike is a highly popular tactical first-person shooter game that pits two teams against each other: the terrorists and the counter-terrorists. Players engage in various objectives, such as bomb defusal or hostage rescue, requiring teamwork and strategy. For those looking to enhance their gameplay experience, using a clash promo code can be beneficial in unlocking new features and items.

The Ultimate Guide to Cashback Loyalty Programs: Tier by Tier Breakdown

Cashback loyalty programs have become increasingly popular among consumers looking to maximize their spending power. These programs allow members to earn a percentage of their purchases back in cash or points, which can be redeemed for a variety of rewards. In this ultimate guide, we will explore the different tiers of cashback loyalty programs, breaking down their features and benefits. Typically, these programs offer multiple tiers, each providing varying levels of rewards and perks based on your spending habits. As you climb the tiers, you may unlock increased cashback rates, exclusive offers, and even personalized services tailored to enhance your shopping experience.

Understanding the structure of cashback loyalty programs is essential for making the most of your rewards. The tiers usually range from basic to premium, each with its own set of requirements for qualifying and enjoying the benefits. For instance, a typical tier breakdown might include:

- Tier 1: Basic members receive 1% cashback on all purchases.

- Tier 2: Silver members earn 1.5% cashback after spending a specified amount.

- Tier 3: Gold members enjoy 2% cashback and priority customer service.

- Tier 4: Platinum members may receive up to 3% cashback, exclusive reward events, and personalized deals.

By choosing the right program and working your way through the tiers, you can significantly increase your cashback earnings and enjoy enhanced loyalty rewards.

Are You Leaving Money on the Table? Exploring the Benefits of Cashback Loyalty Tiers

In today's competitive market, cashback loyalty tiers offer a robust way for consumers to maximize their spending by earning rewards on everyday purchases. Many customers remain unaware of how much money they could be leaving on the table by not taking full advantage of these programs. By understanding the various levels of cashback tiers available, you can effectively select a plan that aligns with your shopping habits. For example, a basic tier might offer a modest percentage back, while higher tiers provide increased percentages along with exclusive perks such as bonus offers and personalized discounts.

Moreover, cashback loyalty tiers not only benefit consumers, but they also cultivate customer loyalty that businesses can leverage for long-term growth. Implementing a tiered rewards system encourages repeat purchases, as shoppers will strive to reach the next level for better rewards. This symbiotic relationship between consumers and businesses highlights the importance of maximizing these programs. So, before you make your next purchase, assess your loyalty program options—are you fully capitalizing on the opportunities available to you, or are you, quite literally, leaving money on the table?